When the target Fed Funds Rate was at 5.25% and the housing market was in full booming swing, we began our crusade to refinance many of our longer term rental properties.

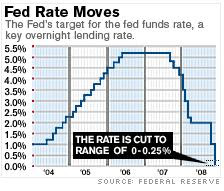

We believed (certainly not to this extent) that the Fed Funds Rate would hold steady and ultimately begin to trend lower in time. After all, as you can see in the chart above, once the rate left 1% it slowly began to inch higher towards it resting place at 5.25%. We played our hand with our money placed securely on the "everything cycles button". It was "down's" turn.

Consequently, to take advantage of the cash that had accrued during the times of ridiculous appreciation rates experienced by many, we leveraged most of our properties using HELOC's (Home Equity Lines of Credit). The rates on these HELOC's were based on the banks margin plus the Fed Funds Rate. Our option was to lock this rate or leave it variable. Obviously, based on our thoughts above, we opted to leave our rate variable.

The Fed Funds Rate goes up, so does our interest rate and mortgage payment. The Fed Funds Rate goes down, so does our interest rate and mortgage payment. At the time, the Fed Funds Rate was at 5.25%. With today's move, the Fed Funds Rate has dropped 5% and, by the same amount (5%), so has the interest rates on our HELOC's.

You can see why the Fed Funds Rate is, in the world of finances, unbelievably important to us. Is it that important to you?