Dec 31, 2008

Inside the Case-Shiller Housing Numbers

Karl Case, co-creator of the Case-Shiller housing price index, goes behind the housing numbers just released for October 2008. Aside from Florida, California, Nevada, and Arizona, is stability returning to most housing markets in 2009?

Dec 22, 2008

An Economic Discussion

A nice round table panel of "experts" discussing our current economic conditions, the Fed, and our future.

Dec 20, 2008

Open House! Do They Really Work?

Open houses. Do you or an assistant hold "open homes" on your listings? If so, why? Are you simply creating a perception for your seller that you're doing everything within your powers to sell their home or do you actually have good success selling homes through the "open home" buyer traffic? Networking and lead generation is a given but, again, what about the main objective of actually selling the home?

Dec 19, 2008

Searching for Answers: Stimulous, TARP, Bailouts

Searching for economic answers. Looking for anything that will provide relief to this economic disaster. Everyone seems to have answers but no-one seems to have working solutions. This video will merely provide another perspective courtesy of Laura Tyson, professor at the Haas School of Business of the University of California, Berkeley.

Dec 18, 2008

Risky ... Really?

I don't get it. Now, don't get me wrong, putting together all of the pieces of a puzzle to get the full picture, to understand the entire story, is not easy and is usually a constant struggle. Specifically, I'm talking about Real Estate, but my comments would suffice for most anything that cycles.

Why is it when everyone should be buying real estate at bargain basement prices, only a few are while the overwhelming majority don't have the means? The easy answer is that times, economically speaking, are tough. I get it, people are losing jobs, loans are much tougher to obtain, most everything financially speaking has gotten tighter aside from the drastic drop in oil and gas prices over the past few months.

Again, why do most people find themselves confronted with these unfortunate circumstances? I thought the safe play was to simply get a 9:00-5:00 job, put your money in the bank, work until you're 72, and then call it a day. After all, investing is risky in lieu of the safety of that weekly paycheck. Right?

For me, this is where the confusion sets in. Most people don't involve themselves heavily in investing yet they spend forty plus hours a week working. For what? In terms of financial security, if this was the best, least risky approach, how come most of these same individuals are not financially independent after countless hours, days, years, and decades of hard work?

Someone should have told the likes of Warren Buffett, Bill Gates, Richard Branson, etc. Sure, I get it, these guys are different, simply ordained by a higher power to find themselves in a position of being rich (again speaking strictly in terms of finances) or, perhaps they've spent the time, devoted the effort, and dedicated their passion learning to become the best. Oh yeah, that little thing called education.

I guess if you want to have what most everyone else has (again, financially speaking), I would urge you to do what most everyone does. Otherwise, I'd spend a lot of time looking for another way. Yeah, the road less traveled. It may be a bumpy ride along the way but your travels will often leave you finding yourself alone in vast fields full of trees loaded with fruit waiting to be picked. Or, you could wait in line at 3:00 in the morning outside of your favorite store during the Holidays hoping that in a matter of hours you'll have the opportunity to fight with thousands of others to potentially get one of the five flat screen TVs advertised for half off.

Are you sure investing is risky? Scarier perhaps, but definitely not riskier than that secure 9:00-5:00. Yes, you may lose money on your investments as easily as you may get that pink slip. Don't believe me, just look around you. There's a better way but you have to spend some time looking, learning, and being. How can you afford not to?

Why is it when everyone should be buying real estate at bargain basement prices, only a few are while the overwhelming majority don't have the means? The easy answer is that times, economically speaking, are tough. I get it, people are losing jobs, loans are much tougher to obtain, most everything financially speaking has gotten tighter aside from the drastic drop in oil and gas prices over the past few months.

Again, why do most people find themselves confronted with these unfortunate circumstances? I thought the safe play was to simply get a 9:00-5:00 job, put your money in the bank, work until you're 72, and then call it a day. After all, investing is risky in lieu of the safety of that weekly paycheck. Right?

For me, this is where the confusion sets in. Most people don't involve themselves heavily in investing yet they spend forty plus hours a week working. For what? In terms of financial security, if this was the best, least risky approach, how come most of these same individuals are not financially independent after countless hours, days, years, and decades of hard work?

Someone should have told the likes of Warren Buffett, Bill Gates, Richard Branson, etc. Sure, I get it, these guys are different, simply ordained by a higher power to find themselves in a position of being rich (again speaking strictly in terms of finances) or, perhaps they've spent the time, devoted the effort, and dedicated their passion learning to become the best. Oh yeah, that little thing called education.

I guess if you want to have what most everyone else has (again, financially speaking), I would urge you to do what most everyone does. Otherwise, I'd spend a lot of time looking for another way. Yeah, the road less traveled. It may be a bumpy ride along the way but your travels will often leave you finding yourself alone in vast fields full of trees loaded with fruit waiting to be picked. Or, you could wait in line at 3:00 in the morning outside of your favorite store during the Holidays hoping that in a matter of hours you'll have the opportunity to fight with thousands of others to potentially get one of the five flat screen TVs advertised for half off.

Are you sure investing is risky? Scarier perhaps, but definitely not riskier than that secure 9:00-5:00. Yes, you may lose money on your investments as easily as you may get that pink slip. Don't believe me, just look around you. There's a better way but you have to spend some time looking, learning, and being. How can you afford not to?

Dec 17, 2008

The Twitter Difference

I don't need to spend countless characters explaining the potential power of Twitter from a business perspective. It's quite obvious isn't it? Networking, content, leads, the list can go on and on. In fact, we're working on a potential real estate investment project with another member of Twitter. Until Twitter, we never knew each other (more to come in future posts). Priceless marketing and lead generation for merely the cost of your time and efforts.

As with other social networking platforms such as Facebook or MySpace, more of our personalities actually come to life through our online virtual presence with these sites. With Twitter, these characteristic seem to be exemplified through the bite-sized conversational guidelines in which we are confined.

What's intriguing to me is that I actually feel like I'm getting to know people. Believe me, I know this is merely a glimpse but it's a good glimpse. We have an opportunity to see what people look like, get to read about their changing moods, where they're eating, what they're eating, where they're going, with whom they're interacting with, how they interact, their likes, dislikes, whether they're night owls, early risers, or both .... you name it, crudely speaking, we can actually begin to formulate a reasonable feel for what these people would be like in real life. Couple this with the nuggets of content that these individuals throw out from time to time, whether it be a news event or merely a topic of their interest or perhaps it's an article or video they're sharing on their blog or a TwitPic of where they're at or that of their children or that of a sunset or perhaps themselves, etc. Through my run-ons, I think you get the point.

Adding to the fascination, some people seem to change their picture daily. Some vacillate between avatars and actual pictures. Some people are festive and adorn themselves with holiday attire while others refuse to visibly partake in the holiday dress up. You have trend setters changing early into their costumes while you have procrastinators just now making the change.

Plug all of these detailed pieces of the puzzle together and you begin to get real perspective. Ultimately, video will bridge this online virtual divide by portraying us for who we are. It won't be exact as there will always be actors, but closer. Until then, Twitter's enabling us to get a much improved view and this view, in my opinion, is one of the more captivating attributes that keep us obsessively coming back for more. Now, we're actually putting a face to the name and 24-hour emotions behind our words. Real life unfolding 140 characters at a time. We may have never met but were certainly getting to know each other in a real way.

As with other social networking platforms such as Facebook or MySpace, more of our personalities actually come to life through our online virtual presence with these sites. With Twitter, these characteristic seem to be exemplified through the bite-sized conversational guidelines in which we are confined.

What's intriguing to me is that I actually feel like I'm getting to know people. Believe me, I know this is merely a glimpse but it's a good glimpse. We have an opportunity to see what people look like, get to read about their changing moods, where they're eating, what they're eating, where they're going, with whom they're interacting with, how they interact, their likes, dislikes, whether they're night owls, early risers, or both .... you name it, crudely speaking, we can actually begin to formulate a reasonable feel for what these people would be like in real life. Couple this with the nuggets of content that these individuals throw out from time to time, whether it be a news event or merely a topic of their interest or perhaps it's an article or video they're sharing on their blog or a TwitPic of where they're at or that of their children or that of a sunset or perhaps themselves, etc. Through my run-ons, I think you get the point.

Adding to the fascination, some people seem to change their picture daily. Some vacillate between avatars and actual pictures. Some people are festive and adorn themselves with holiday attire while others refuse to visibly partake in the holiday dress up. You have trend setters changing early into their costumes while you have procrastinators just now making the change.

Plug all of these detailed pieces of the puzzle together and you begin to get real perspective. Ultimately, video will bridge this online virtual divide by portraying us for who we are. It won't be exact as there will always be actors, but closer. Until then, Twitter's enabling us to get a much improved view and this view, in my opinion, is one of the more captivating attributes that keep us obsessively coming back for more. Now, we're actually putting a face to the name and 24-hour emotions behind our words. Real life unfolding 140 characters at a time. We may have never met but were certainly getting to know each other in a real way.

Dec 16, 2008

Fed Funds Rate - What's in It for You?

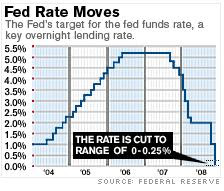

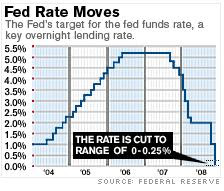

In today's FOMC meeting, the Fed cut the Fed Funds Rate from 1% to a range between Zero and .25%. Do you care? Will you be impacted? These rate cuts are directly impacting us at the Buzz. For now, very positively.

When the target Fed Funds Rate was at 5.25% and the housing market was in full booming swing, we began our crusade to refinance many of our longer term rental properties.

We believed (certainly not to this extent) that the Fed Funds Rate would hold steady and ultimately begin to trend lower in time. After all, as you can see in the chart above, once the rate left 1% it slowly began to inch higher towards it resting place at 5.25%. We played our hand with our money placed securely on the "everything cycles button". It was "down's" turn.

Consequently, to take advantage of the cash that had accrued during the times of ridiculous appreciation rates experienced by many, we leveraged most of our properties using HELOC's (Home Equity Lines of Credit). The rates on these HELOC's were based on the banks margin plus the Fed Funds Rate. Our option was to lock this rate or leave it variable. Obviously, based on our thoughts above, we opted to leave our rate variable.

The Fed Funds Rate goes up, so does our interest rate and mortgage payment. The Fed Funds Rate goes down, so does our interest rate and mortgage payment. At the time, the Fed Funds Rate was at 5.25%. With today's move, the Fed Funds Rate has dropped 5% and, by the same amount (5%), so has the interest rates on our HELOC's.

You can see why the Fed Funds Rate is, in the world of finances, unbelievably important to us. Is it that important to you?

When the target Fed Funds Rate was at 5.25% and the housing market was in full booming swing, we began our crusade to refinance many of our longer term rental properties.

We believed (certainly not to this extent) that the Fed Funds Rate would hold steady and ultimately begin to trend lower in time. After all, as you can see in the chart above, once the rate left 1% it slowly began to inch higher towards it resting place at 5.25%. We played our hand with our money placed securely on the "everything cycles button". It was "down's" turn.

Consequently, to take advantage of the cash that had accrued during the times of ridiculous appreciation rates experienced by many, we leveraged most of our properties using HELOC's (Home Equity Lines of Credit). The rates on these HELOC's were based on the banks margin plus the Fed Funds Rate. Our option was to lock this rate or leave it variable. Obviously, based on our thoughts above, we opted to leave our rate variable.

The Fed Funds Rate goes up, so does our interest rate and mortgage payment. The Fed Funds Rate goes down, so does our interest rate and mortgage payment. At the time, the Fed Funds Rate was at 5.25%. With today's move, the Fed Funds Rate has dropped 5% and, by the same amount (5%), so has the interest rates on our HELOC's.

You can see why the Fed Funds Rate is, in the world of finances, unbelievably important to us. Is it that important to you?

Subscribe to:

Posts (Atom)

Embracing Good Debt in Real Estate: A Smart Investor's Guide to Building Wealth

Building Wealth Using Good Debt Embracing Good Debt in Real Estate: A Smart Investor's Guide to Building Wealth Are you intrig...

-

If you're on Twitter, drop us a comment leaving your profile page in our "comments" section in order for us to follow you. We ...

-

Real Estate Professionals, what (cell / smart) phone are you using: 1) RIMM / BlackBerry Product 2) Apple / iPhone Product 3) Google / Andro...

-

Discovering the little button we've all been seeing in our latest rounds of Google searching. If you like what your Google search has f...